Product Positioning Strategy: How to answer the 3 key positioning questions

Developing a clear product positioning strategy is key to establishing and conveying a unique value proposition to your customers. Strong positioning makes it easier for your customer to see why they should indeed buy your product. It makes your value very apparent to them.

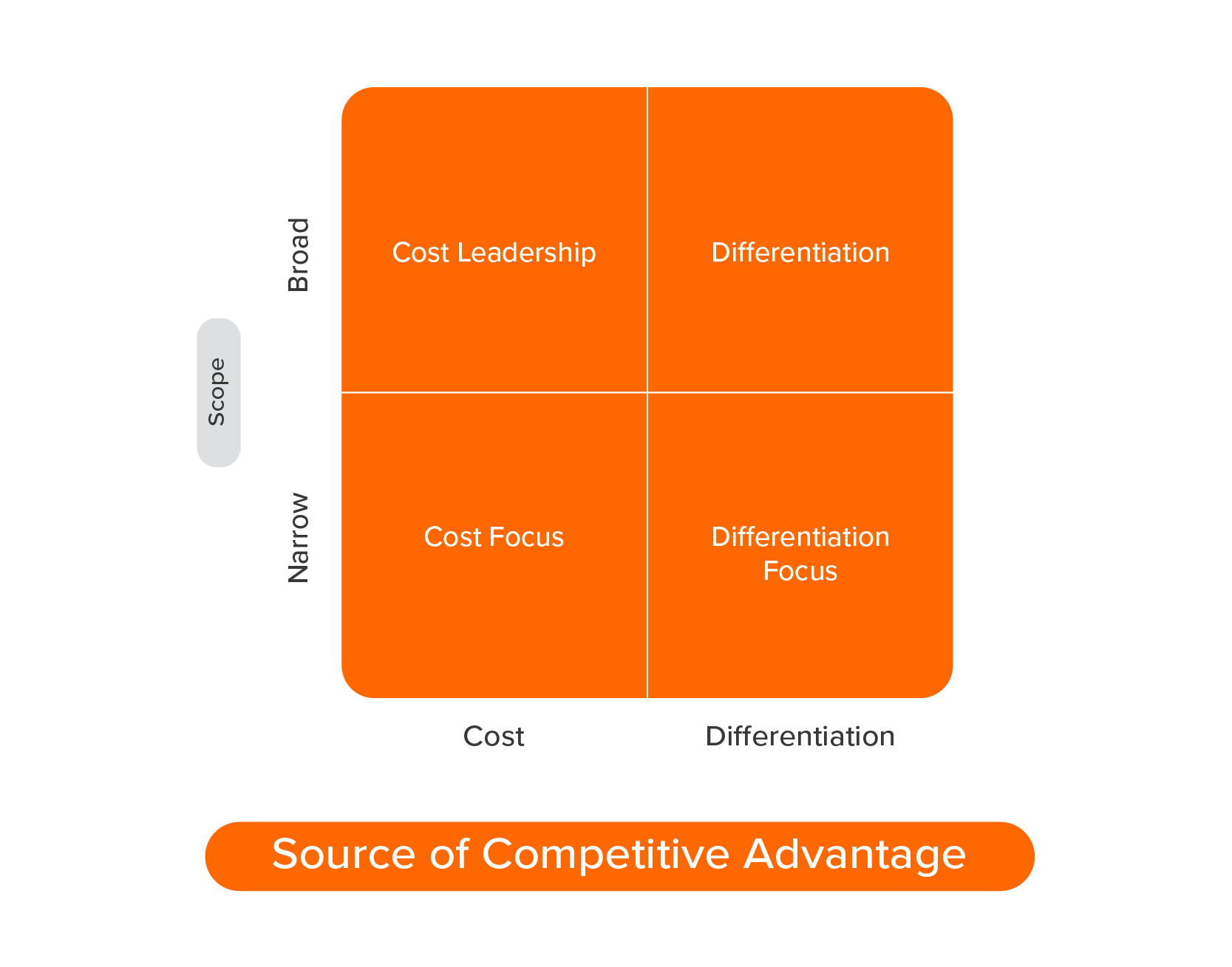

To strengthen your value proposition, you need to look at your product positioning strategy. What approach do you use? What is your product positioning strategy? In the traditional approach to positioning, for example, positioning as described by Harvard Business School’s Micheal Porter, companies talk about how they create value using either price or features.

Alternatively, they might position themselves as catering to the broad or narrow market. For example, Apple and Google Maps cater to the broad market of people trying to get to a destination on time, while Waze caters to the narrower market of people who might have frequent, unfamiliar stops on their journey.

Through this lens, for a lot of companies, the sum total of their options - in terms of positioning strategy or stating competitive advantage - might look something like this:

Thinking through Porter’s recommendations, you are left trying to answer the following questions:

Thinking through Porter’s recommendations, you are left trying to answer the following questions:

- Should you target a broad market or a niche market?

- Should you price your product higher than competitors or less than competitors?

- Should you satisfy needs differently (or should you satisfy different needs) than competitors or rely on your price differentiation?

In his blog, we will give you an approach - called Jobs-to-be-Done - to answering these questions.

What is Jobs-to-be-Done

Jobs-to-be-Done is a theory and a framework that helps you to focus your product roadmap on the goal that customers are trying to achieve using your product. Using the JTBD framework, you can align your product roadmap and your positioning strategy with your customer’s goals.

Using Jobs-to-be-Done to answer key positioning questions

Let’s take on the 3 questions arising out of Porter’s recommendations one by one.

Question 1: Should your positioning strategy target the broad or niche market?

There are four steps to answering this key question around positioning strategy.

Step 1: Define your market.

Make sure you define your market by a customer job-to-be-done and not by a product. For example, your first impulse might be to say that Google and Apple Maps are in the “navigation app” market. However, when you are using the JTBD lens, you will focus on the job - or goal - that customers use a product for, independent of the solution.

People use Google and Apple Maps to “find their way to unknown destinations” or to “get to a destination on time.” In other words, the market for Google and Apple maps comprises people who need to get to destinations on time.

Step 2: Assess your growth goals.

You need to know how much revenue you want to generate because that will tell you if:

A - Your product positioning needs to target the broad market to have a big enough opportunity,

or if,

B - There is enough opportunity in the niche market.

Of course, this ties in with factors such as your organization’s size and footprint, how it is funded and the costs that go into the development of your product.

Step 3: Size the market.

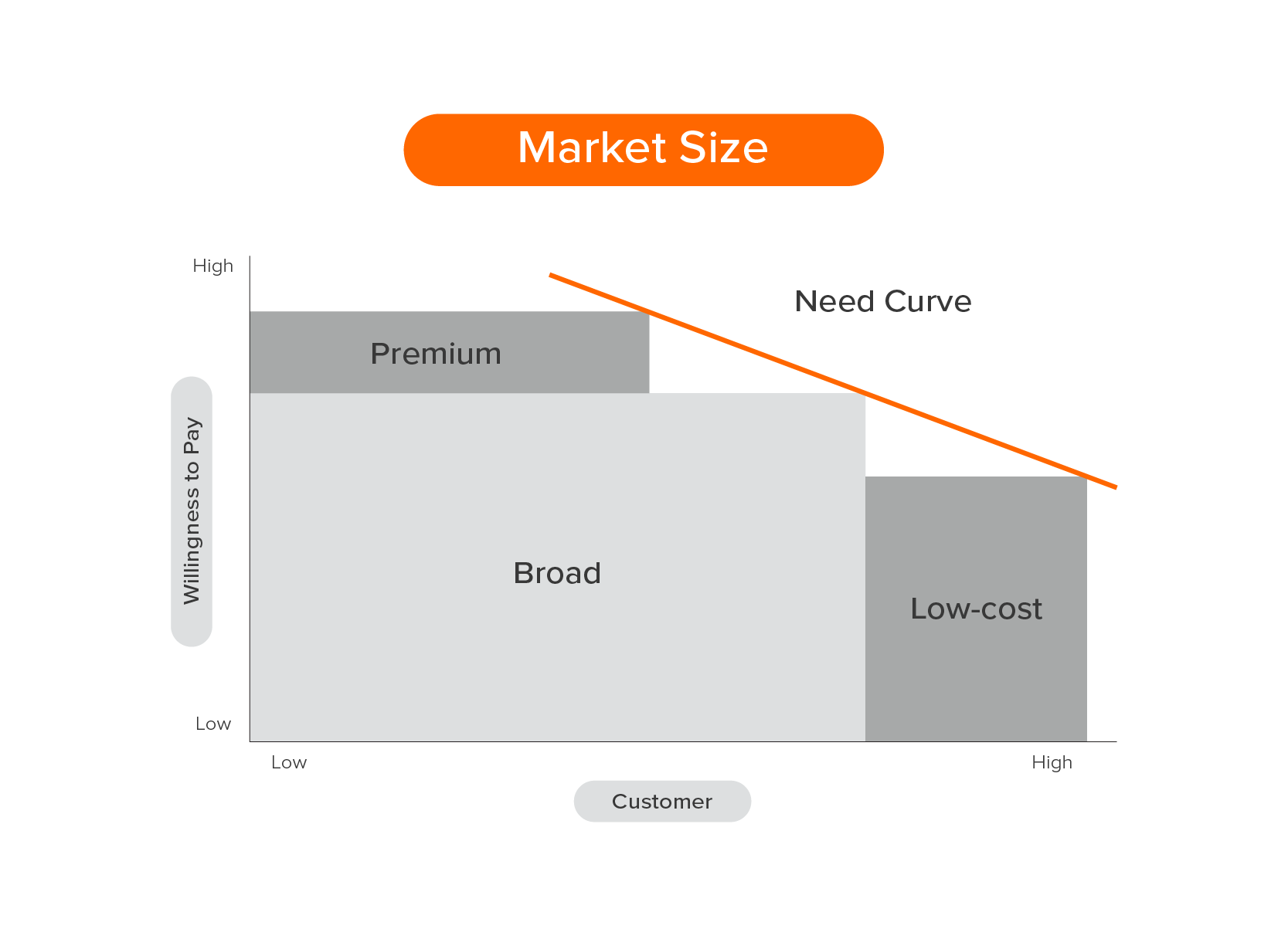

The traditional approach to sizing a market would be product price multiplied by the number of buyers. Sizing your market using JTBD is about your customer’s Willingness to Pay (WTP) to get the job done, which impacts pricing and, therefore, your product positioning strategy.

The JTBD approach can help you size your market based on the price that your customer is willing to pay to achieve their goal (the same goal that they are looking to achieve by using your product).

You need to start by gathering data to avoid incorrect data becoming the reason for your calculations - and consequently, your product positioning strategy - becoming skewed. Go directly to your customer and identify the range of their WTP to get the job done using interviews and surveys. Chart the answers on a scatter plot and draw a best-fit line through the points. The area under the curve is the size of your market.

Step 4: Follow the customer’s struggle

If the market is more than large enough to achieve your growth goals, your positioning strategy should target a specific segment that struggles more to get the job done and is still big enough to support your growth goals.

Because of their struggle, the segment is more likely to adopt new solutions faster.

If you can find a small segment big enough to achieve your goals, you have a good reason to go niche and focus on the narrow market. Otherwise, the best approach may be to go broad.

Question 2: Should you price your product higher or less than competitors?

The first point here is that rather than thinking about competitor pricing, you should think about your target segment’s WTP to get the job done. Pricing relative to competitors might lead you to undercharge for the value you provide or over-charge if you are targeting the low-cost segment.

Above, we suggested you choose your target segment based on the group of people who struggle the most and whose aggregate WTP represents a market size that is big enough for you to achieve your revenue growth goals.

It’s likely that not everyone in your target segment is willing to pay the same price. WTP exists on a curve. We call this a need curve. Using the need curve, you can narrow your segment further to fine-tune your product positioning strategy. It could be that the premium customers in your segment - those who are willing to pay the most - represent a big enough opportunity for you to achieve your growth goals, and you can do so by targeting them

Using the need curve, you can narrow your segment further to fine-tune your product positioning strategy. It could be that the premium customers in your segment - those who are willing to pay the most - represent a big enough opportunity for you to achieve your growth goals, and you can do so by targeting them

The WTP data that you used to size the market can also be used to identify the price points the customer is willing to pay to get the job done.

Weigh the sizes of the premium part of your segment, the mid-market, and the low-cost against your growth goals.

Everyone in the premium segment is willing to pay a certain price that the low-cost segment will not. Do you need the low-cost segment? Can you deliver value against the job cheaply enough that the low-cost pricing will keep you profitable? If not, then your product positioning strategy has to target premium customers.

Another angle to consider is: you need to price your product more than it costs you to deliver it. How much more? People talk about the perceived value of your product which impacts profitability. How do you calculate perceived value? This is where the WTP to get the job done comes in. The perceived value of your product is based on how much of the job it gets done and the customer’s WTP to get that part of the job done.

To improve profitability, your goal could be to find a group of people whose perceived value - and therefore WTP to get the job done - is much higher than your cost of delivery, regardless of what your competitors charge.

Question 3: Should you satisfy needs differently than or rely on price differentiation?

Although this question - or some version of it - is a point that teams mull over all the time while talking about their positioning strategy, it is a false binary. You must satisfy a different set of needs as compared to your competitors or satisfy the same needs more effectively if you want customers to switch to your product.

Once you choose your segment, you need to understand the solutions they currently use to get the job done. They may be direct competitors - products people pay for - or manual solutions that are free to your customers. If you don’t satisfy needs differently, that is, better than the existing solution; it will be hard to create a switch no matter how low your price is.

Why not focus your positioning strategy on just on price? Here’s why: In Adam Davidson’s book Passion Economy, there is a great story about an entrepreneur who buys shoes from a factory in China, that are made from the same materials and boast the same construction as Nike. He sold the shoes - Strykers - much cheaper than Nike.

And failed in trying to take share from Nike.

Why did this happen?

Let’s try looking at how this product positioning strategy failure played out through the Jobs-to-be-Done lens.

Customers were trying to satisfy needs in a job-to-be-done with their shoes. These needs go beyond functional needs, such as the comfort and durability of the shoe. “Looking the way they want” is one of the needs. It didn’t matter how cheap the Strykers were because they didn’t come close to satisfying the emotional needs of the consumer. Differentiating on price alone is a hard game to win. At worst, you sell nothing, like Stryker. At best, you sell more than your competitors but create downward price pressure and sacrifice profitability, which may cause you to search for other revenue models like - in a software context - selling your consumers’ data for profit.

Google Sheets is an example of satisfying needs differently as a product positioning strategy. At first glance, it seems like newbie Google Sheets came along and competed with the incumbent, Microsoft Excel, on price (by being free). However, a closer look using the JTBD lens shows us how Google Sheets actually worked towards meeting customer needs better than the incumbent.

Here’s proof of their positioning: The Google Blog post announcing Google Sheets in 2006 was titled, “It’s Nice to Share.” It talked about how Google wanted to help people “quickly and easily share information in real-time.” The blog post also specifically addressed non-accounting users and usability with words like “your kid's sports coach, your aunt in Omaha trying to organize a major family reunion, your friend who promised to compile a list of all your favorite hiking trails.” Microsoft Excel, in the meanwhile, continued to improve its product for its accounting and finance users.

The best disruption and positioning strategies satisfy different needs for a different segment than the incumbent - Google Sheets is an example of this strategy in motion. Because incumbents flee upmarket to their most profitable customers and continue to satisfy their needs, it looks on the surface like the disruptor is winning because of the lower price. But that’s not how they got the segment to adopt. They satisfied different needs better than the incumbent solution.

To sum up: Focusing on your customer’s job-to-be-done and understanding it in its entirety - with functional, emotional and consumption aspects of the job - helps you to strengthen your product positioning. Price wars alone will not win you the market and might not even be the best way to go (as we saw with Stryker vs Nike).

Put your customer job-to-be-done at the center of your product roadmap with thrv. You get an inbuilt survey mechanism for you to understand customer needs and an automated system for customer effort scores that lead you to focus on their needs and struggles in achieving their goals. You are able to build and position products that answer directly to customer needs.

Want to see how it works? Contact us today.

Posted by Jay Haynes View all Posts by Jay Haynes